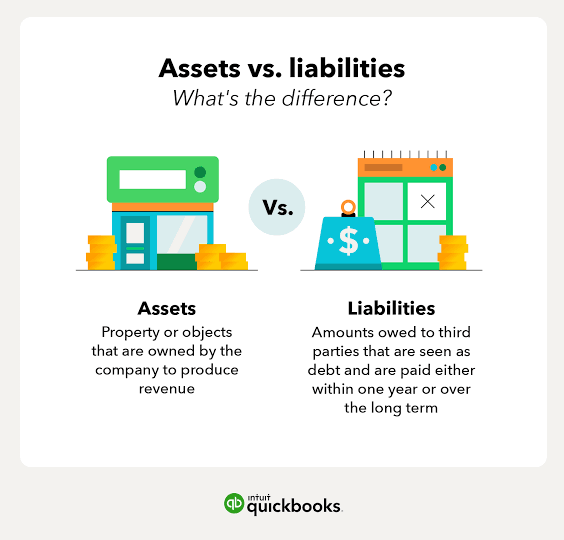

The Difference Between Assets And Liabilities

February 16, 2024 | by luxurymindsets.com

When it comes to managing your finances, understanding the difference between assets and liabilities is crucial. These two terms are often used in the world of finance, but they can be confusing for those who are new to the subject. we will discuss the key points that differentiate assets from liabilities and provide some helpful tips from books to enhance your financial knowledge.

Assets: Your Financial Allies

Assets are the resources that you own and control. They can be tangible or intangible and have value that can be measured in monetary terms. Some common examples of assets include:

- Real estate properties

- Stocks and bonds

- Cash and savings accounts

- Business investments

- Intellectual property rights

The key characteristic of an asset is that it has the potential to generate income or appreciate in value over time. For instance, if you own a rental property, it can generate rental income, making it a valuable asset. Similarly, stocks and bonds can provide dividends and interest, contributing to your overall wealth.

Books can be excellent resources to deepen your understanding of assets. One highly recommended book is “Rich Dad Poor Dad” by Robert Kiyosaki. It emphasizes the importance of acquiring income-generating assets to build wealth. Another insightful read is “The Intelligent Investor” by Benjamin Graham, which provides valuable insights into investing in stocks and bonds.

Liabilities: Financial Obligations

Liabilities, on the other hand, represent your financial obligations or debts. They are the claims that others have on your resources. Common examples of liabilities include:

- Mortgages and loans

- Credit card debt

- Outstanding bills

- Auto loans

- Student loans

Unlike assets, liabilities do not generate income or appreciate in value. Instead, they require you to make regular payments to fulfill your obligations. It’s important to manage your liabilities carefully to avoid excessive debt and financial stress.

For a deeper dive into the topic of liabilities, consider reading “The Total Money Makeover” by Dave Ramsey. This book provides practical advice on how to eliminate debt and manage your liabilities effectively. Another recommended read is “Debt-Free Forever” by Gail Vaz-Oxlade, which offers step-by-step strategies to become debt-free.

Tips for Financial Success

Now that we have a clear understanding of assets and liabilities, let’s explore some tips from books that can help you achieve financial success:

- Focus on acquiring income-generating assets: As Robert Kiyosaki emphasizes in “Rich Dad Poor Dad,” building wealth requires acquiring assets that generate income. Look for opportunities to invest in assets that have the potential to appreciate in value or provide a steady stream of income.

- Reduce and manage your liabilities: Dave Ramsey’s “The Total Money Makeover” advocates for eliminating debt and managing liabilities effectively. Create a budget, prioritize debt repayment, and avoid taking on unnecessary debt.

- Invest in your financial education: Benjamin Graham’s “The Intelligent Investor” highlights the importance of understanding the financial markets and making informed investment decisions. Continuously educate yourself about personal finance and investing to make wise financial choices.

- Build an emergency fund: Gail Vaz-Oxlade’s “Debt-Free Forever” stresses the importance of having an emergency fund to cover unexpected expenses. Aim to save three to six months’ worth of living expenses in a separate savings account.

- Diversify your investments: To mitigate risks and maximize returns, consider spreading your investments across different asset classes. This strategy is discussed in various investment books, including “The Intelligent Investor” by Benjamin Graham.

By understanding the difference between assets and liabilities, and implementing the tips from these books, you can make informed financial decisions and work towards achieving your financial goals. Remember, building wealth is a journey that requires patience, discipline, and continuous learning.

Happy reading and financial success!

RELATED POSTS

View all